Expect the unexpected, says the old adage.

It’s two months since the Russian-Ukrainian war started, and we’ve seen changes that normally take years, if not decades.

From Ukraine starting to accept donations in cryptocurrencies to the ban of Russian banks from SWIFT, the war has substantially reorganized the world of fintech.

Many tech businesses immediately withdrew from Russia and adapted services to uphold international sanctions. Some fintechs even launched completely new initiatives for the cause.

With all this happening almost overnight amidst a global economic downturn, you may wonder what has enabled these companies to make critical decisions so fast.

And most importantly, how can your fintech increase its agility to such a level?

Fintech moving center stage

The scale of donations made by tech companies to humanitarian aid has been immense.

But what is more interesting from the fintech product development perspective is the speed at which those organizations adapt, expand, or even pivot their offerings.

Let’s take the example of three open banking firms Volt, Yapily, and Token, partnering to build a donation page enabling anyone to make fee-free, instant payments to organizations supporting Ukraine.

Or The Credit Thing, created by the co-founder of Ukraine’s first mobile-only bank, adding a feature to its app to let customers donate to the cause.

Or Lithuanian Paysera adjusting its offer to stop processing transactions in roubles, close its Russian clients’ accounts, and restrict money transfers to and from Russian and Belarusian banks.

The secret of agility

While fintechs have always had to move fast to keep their head above the parapet, withdrawing from or restricting services in Russia immediately impacts their revenue.

This level of involvement would be impossible without the space and resources for pivots and innovation – and this calls for a lean IT infrastructure.

And as fintechs are racing to provide customers with more speed, reliability, and 24/7 uptime in products, cloud optimization – including Kubernetes – has become quintessential.

That’s also why reducing cloud complexity is a must. Modern cloud architectures usually involve managing multiple solutions from different vendors, APIs, microservices, and more. If you want to take your agility to the next level, you can’t rely on old processes.

And one of the critical areas to help you accomplish this goal is cloud automation.

What can cloud automation do for your fintech?

There are many benefits your company can reap thanks to automating cloud operations, but in a nutshell, they boil down to streamlining processes and reducing costs.

This, in turn, frees space and resources – both human and capital – to cater to unexpected pivots, increasing your fintech’s overall agility and resilience.

The most important aspects of your cloud operations that you can enhance as a result of automating Kubernetes involve:

- Deploying Infrastructure-as-Code (IaC) to help you extend control over almost all infrastructure elements and facilitate the orchestration of more complex systems.

- Reducing IT infrastructure expenses by eliminating manual tasks and freeing your engineers to respond proactively to a dynamic situation.

- Enabling continuous integration and deployment (CI/CD) by automating the application deployment pipeline to enable more frequent and faster updates.

- Improving cloud security and governance by reducing the risk of human-made error and account compromise, but also setting up resources in a standardized way across your company.

So here’s how it translates into relieving everyday challenges most dev teams face.

Solving everyday challenges with cloud automation

One of the core issues dev teams face every day is provisioning cloud resources. While stateless apps are an excellent use case for Kubernetes, stateful applications can present quite some challenges.

Using an instance selection algorithm, cloud automation can handle the tasks of rightsizing and autoscaling your infrastructure in real-time to the changing demand. As a result, your team can spin up new products without having to request DevOps to provision resources.

This saves you time and money, but also unlocks space for ideation and innovation – so much needed if your business is to be proactive, and not just reactive.

And when you’re done with product experiments, the same software platform can automatically decommission the resources you no longer need. No more orphaned instances, no more shadow IT issues.

Cloud automation can detect all workloads and pick resources according to their needs and remove unused instances before they run up a horrendous bill. This means that both engineering and finance teams can rest assured that even if developers forget to shut down instances manually, these won’t incur extra charges.

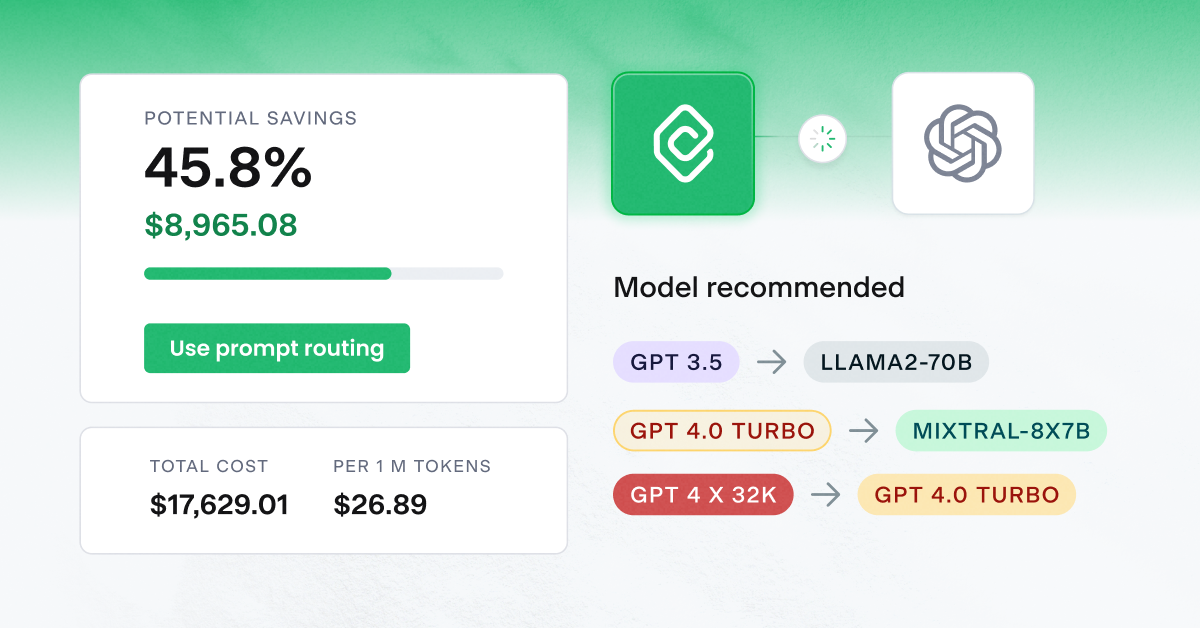

Finally, automating cloud optimization can bring massive savings – even 90% off the regular on-demand price. By combining spot instance automation with cluster scheduling, you can get great results without compromising performance.

And then invest the surplus in new product initiatives, compensate for forfeited revenue, or simply donate to the refugees.

Keep calm and carry on building your fintech product

Sadly, the war on Ukraine and a global economic downturn show no signs of abating – and nobody can tell for sure how long this stark situation will last.

Nonetheless, crises can also be an opportunity for growth and carving out a new competitive position–but to do so, companies need to be agile enough.

Kubernetes automation certainly helps increase your agility by reducing unnecessary cloud complexities, freeing your engineers, and reducing costs.

So when you aim to expect the unexpected, turn to cloud automation to increase your fintech’s agility – today and in the long haul.

Leave a reply