As the global economy flounders, investors rush to safer equities and VCs are no longer amused by cash-burning startups. We’re seeing deep changes in investor sentiment impacting the tech industry right now.

A lot of tech businesses saw massive user base increases during the pandemic. Now that the pandemic is more or less “over,” the economy is shifting in another direction, and consumers struck by rising prices are no longer willing to spend extra on rides or meal delivery.

On top of that, the pandemic-related lockdowns in China are affecting tech giants that have been around longer. Apple said China’s lockdowns are bound to keep on hitting sales, while EV companies like Tesla struggle to maintain production in the country.

Somehow in all of this, businesses miss out on one great opportunity for increasing gross margins they can benefit from immediately – reducing cloud costs.

Let’s get to the bottom of what’s happening and see what tech companies can do right now to survive the recession.

Are we in for another dot-com bust?

Inflation in the U.S. has been hovering around 8.5%, a mind-boggling four-decade high. Amid skyrocketing inflation, rising interest rates, a war in Ukraine, and broken supply chains, prices are rising to the point of unbearable. Call it an economic slowdown, correction, or recession – markets are already experiencing it.

Tech companies that hired like crazy during the pandemic saw their stock prices plummet dramatically. The tech-heavy Nasdaq Composite recorded its fifth consecutive weekly decline, the longest losing streak since 2012.

Companies left and right are slashing their valuations. Instacart reduced its valuation to c. $24 billion from $39 billion. The largest global tech players lost some $1 trillion in value in just three trading sessions between May 4 and 6, 2022. Last year, we saw about 53 tech companies go public – today, all but three are trading below their offer price or opening price.

This directly translates to investor sentiment. In Q1 2022, VCs invested $70.7 billion in US-based companies. It’s a 35% decline from the previous quarter.

No wonder businesses large and small and being extra careful now. Uber said it will treat hiring as a privilege and focus on cost-cutting like never before. Meanwhile. Facebook’s parent company Meta told staff it would stop or slow the hiring pace for specific roles.

This is worrying, but not as much as layoffs happening all over the industry. According to Layoffs.fyi, 29 startups began laying off employees in April 2022. Following Robinhood’s firing of 9% of its workforce, the fast-delivery startup GoPuff cut its staff by 3% (400 employees) and Peloton plans to lay off about 2,800 workers after a stream of management mistakes.

Netflix started by cutting a group of 25 people from its content marketing project Tudum to continue with laying off 150 US-based staffers. Thrasio, Cameo, Mural, On Deck, and MainStreet followed.

When companies are in cash trouble, they usually go after their investments and strive to cut operation costs before moving to the painful layoffs that echo in the industry.

Many are now looking into opportunities for quick wins and somehow forget about cloud costs. And the cloud bill is an excellent candidate for optimization, potentially making a huge difference to gross margins.

Tech companies aren’t saving as much as they could on the cloud

Cloud costs make up a big chunk of every budget today and will hit 51% of IT spending by 2025 and continue increasing. Still, businesses struggle to balance cost and performance in the cloud, often buying too much capacity, paying for unused resources, and failing to benefit from discounts.

But cloud costs don’t have to spiral out of control. Teams can start saving up big immediately, without having to wait for committed use discounts to make a difference a year from now.

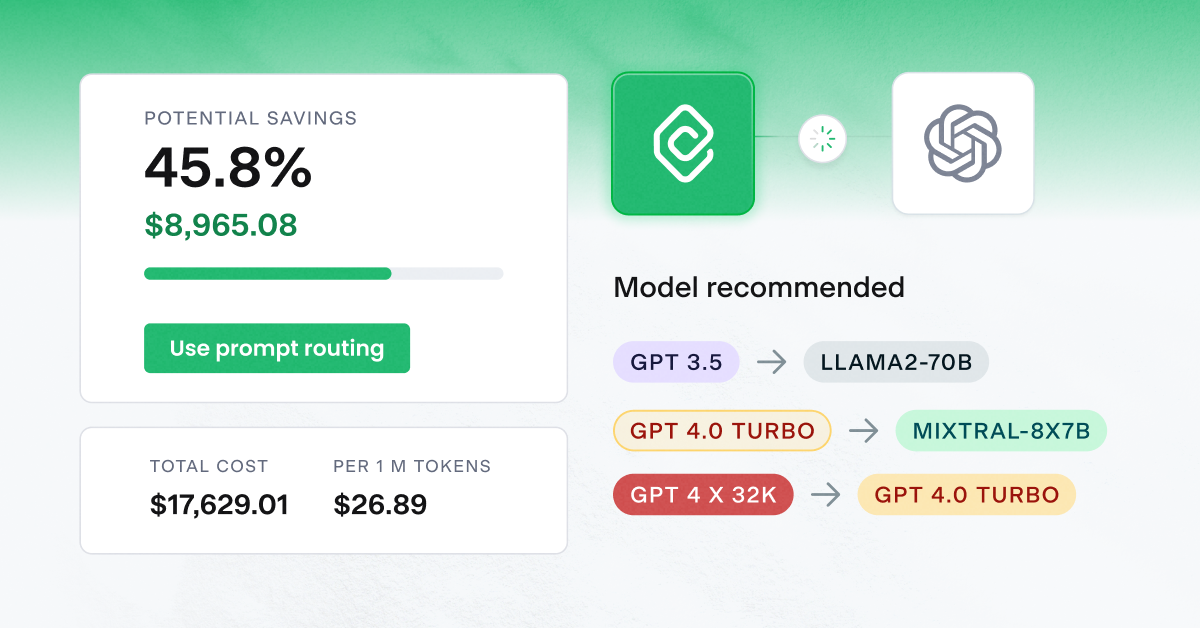

Specialized automation tools actually solve the problem of resource waste by adjusting capacity in real-time depending on the application’s needs.

CAST AI automates the optimization of cloud infrastructure in line with business priorities like price and performance, without any upfront costs or extra engineering effort. The platform pioneers the 3-Step Cost Control process that starts with analysis gets you to an optimized state in minutes and keeps costs down thanks to continous automation.

A leading mobile marketing company Branch saved several millions of dollars per year in AWS compute costs while maintaining its reliability SLAs with CAST AI.

“The modest amount of effort by our team makes this one of the highest ROI cloud cost savings initiatives we’ve done at Branch,” said Mark Weiler, Senior VP of Engineering at Branch. Find out more about how Branch increased its margins – read the case study.

Leave a reply

I like the efforts you have put in this, regards for all the great content.